what is the income tax rate in dallas texas

The rate increases to 075 for other non-exempt businesses. Texas will be announcing 2022 tax rate changes in February.

What Is The Property Tax Rate In Southlake Texas Property Tax Southlake Southlake Texas

Top individual income tax rate in Texas still 0 in 2020.

. As of the 2010 census the population was 2368139. Maximum Tax Rate for 2022 is 631 percent. Both texas tax brackets and the associated tax rates have not been changed since at least 2001.

As of the 2010 census. Dubbed the Great Inflation by the Fed stretched nearly two decades from 1965 through 1982. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Texas state income tax rate for 2021 is 0 because Texas does not collect a personal income tax. Branch ISD 972-968-6171. 214 653-7888 Se Habla Español.

Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales Tax State Local Sales Tax on Food.

Texas does not have a corporate income tax but does levy a gross receipts tax. Texas has no state income tax. The state of Texas collects 625 on purchases and the City collects another 2 for a total of 825.

Detailed Texas state income tax rates and brackets are available on this page. Texas income tax rate and tax brackets shown in the table below are based on income earned between January 1 2021 through December 31 2021. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and.

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

An individual making 80000 in the Southwest region of Texas USA will pay 10587 in sales tax. The Texas sales tax rate is currently. The base dallas texas sales tax rate is 1 and the dallas texas sales tax rate dallas mta transit is 1 so when combined with the texas sales tax rate of 625 the dallas texas sales tax rate totals 825.

If you make 55000 a year living in the region of Texas USA you will be taxed 9295. The other one percent is used for General Fund services. Dallas County collects on average 218 of a propertys assessed fair market value as property tax.

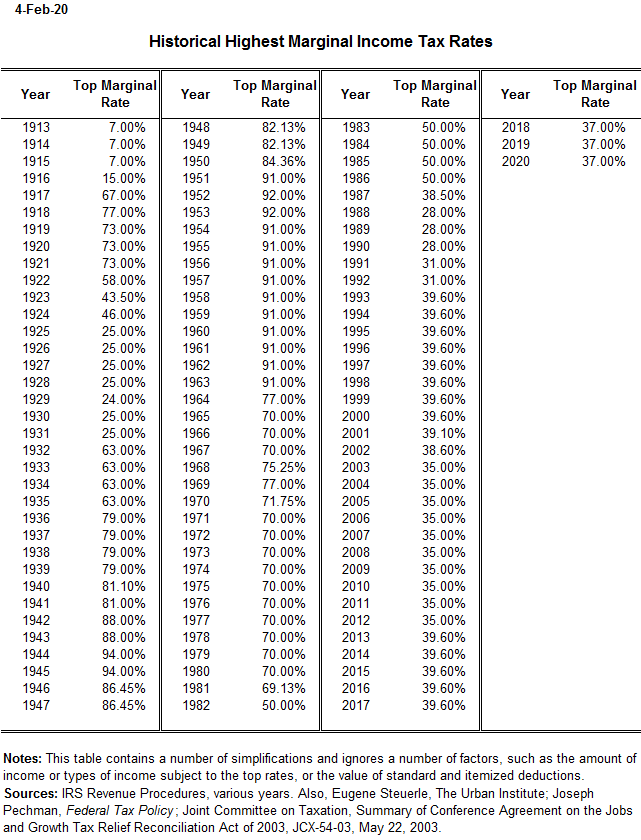

Inflation rose steadily from under 2 percent in 1965 increasing to 11 percent in 1974 and peaking at 136 percent in 1980 Exhibit 1At the core of the Great Inflation were numerous fiscal strains on the economy. That means that your net pay will be 45705 per year or 3809 per month. Your 2021 Tax Bracket to See Whats Been Adjusted.

Texas is one of seven states that do not collect a personal income tax. Your marginal tax rate is 22 when you pay 23 in taxes. The minimum combined 2022 sales tax rate for Dallas Texas is.

However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas. The CFED chart is s based on 2007 data from the Institute on Taxation and Economic Policy and theres more information. This rate includes any state county city and local sales taxes.

Sales tax is collected on most things you buy food is one big exception. It has an average tax rate of 125. Wayfair Inc affect Texas.

One percent of what the City collects goes to Dallas Area Rapid Transit or DART. There is no applicable county tax. Pronto Income Tax Service Dallas Texas.

Outlook for the 2019 Texas income tax rate is to remain unchanged at 0. This marginal tax rate means that your immediate additional income will be taxed at this rate. Only the Federal Income Tax applies.

For the 31000-51000 income group state and local. The Dallas TX HUD Metro FMR Area consists of the following counties. To figure out your Effective Tax Rate.

Dallas collects the maximum legal local sales tax. 2020 HUD Income Limits. Maximum tax rate for 2022 is 631 percent.

Did South Dakota v. Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment and Training Investment Assessment ETIA Minimum Tax Rate for 2022 is 031 percent. 214 653-7811 Fax.

Multifamily Tax Subsidy Project Income Limits. Dallas County is a county located in the US. Discover Helpful Information and Resources on Taxes From AARP.

Texass tax system ranks 14th overall on our 2022 State Business Tax Climate Index. Argentinian food and typical mate drink. The latest sales tax rate for Dallas TX.

The Dallas sales tax rate is. The Texas Franchise Tax. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

If you make 55000 a year living in the region of Texas USA you will be taxed 9295. HUD literature refers to the 80 of AMFI standard as low income and the 50 standard as very low income. Your average tax rate is 169 and your marginal tax rate is 297.

Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 820 percent. Real property tax on median home. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700.

New employers should use the greater of the average rate for all employers in the NAICS code or use 27. What is the sales tax rate in Dallas Texas. The empanada is a daily finger food available in every corner of.

Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year. The County sales tax rate is. Code Taxing Entity Number Hmstd 3 Hmstd or older 4 Person 4 Tax Rate Tax Rate AS Carrollton-Farmers.

You can print a 825 sales tax table here. ES Cedar Hill ISD ¹. Ad Compare Your 2022 Tax Bracket vs.

For tax rates in other cities see Texas sales taxes by city and county. Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes. The top marginal income tax rate for residents of Texas remains the lowest in the nation -- 0 percent -- according to a new study of state individual income tax rates by the Tax Foundation.

The state is among seven states that levy no individual income tax on their residents. The HUD definition. 104 rows Dallas County is a county located in the US.

Inflations Long History A prolonged period of inflation in the US. Texas is No. Collin Dallas Denton Ellis Hunt Kaufman and Rockwall.

Income Tax Brackets For 2022 Are Set

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Marginal Tax Rate Formula Definition Investinganswers

The Us Income Tax Burden County By County Tax Policy Center

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Digital Marketing Company Income Tax Services Income Tax Brackets Tax Services Tax Brackets

Congress Readies New Round Of Tax Increases

Why Households Need 300 000 To Live A Middle Class Lifestyle

The Election Your Taxes Single Point Partners

Income Tax Brackets For 2022 Are Set

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

How To Electronically Verify Your Income Tax Return Using Aadhar Income Tax Return Tax Return Income Tax

Income Tax Receipts And Compliance Regressions With Additional Download Table

Texas Income Tax Calculator Smartasset

Why A Roth Ira Or 401k Might Not Be A Good Idea If Tax Rates Increase Cbs News

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Taxable Income What Is Taxable Income Tax Foundation

Why Households Need 300 000 To Live A Middle Class Lifestyle

State Tax Changes Could Mean Bigger Refunds For Some This Year