capital gains tax canada crypto

Since he purchased the BTC back in 2020 for 20K CAD he has now realized a gain of 40000 CAD. Thus if an investor buys 10000 worth of crypto from an exchange the investor has to pay tax on crypto in Canada.

Crypto Tax Free Countries 2022 Koinly

With 247 trading and investment minimums as low as 10 its so easy to get started.

. The tax return for 2021 needs to be filed by the 30th of April 2022. With no gains in the current tax year you use 4000 to offset your capital gains from 2021. In a nutshell you do not need to report purchases of cryptocurrency if you simply purchase it and hold it.

Do I have to declare crypto on taxes Canada. The next day you use that Bitcoin to purchase an item. The person spending the crypto might have to pay tax on capital gains.

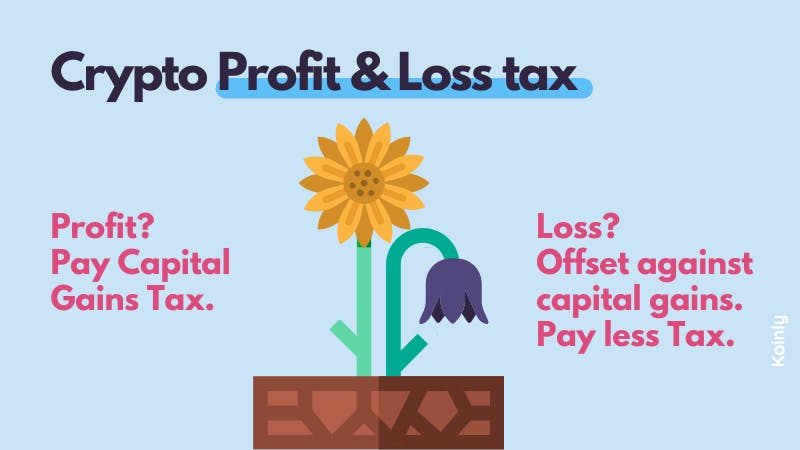

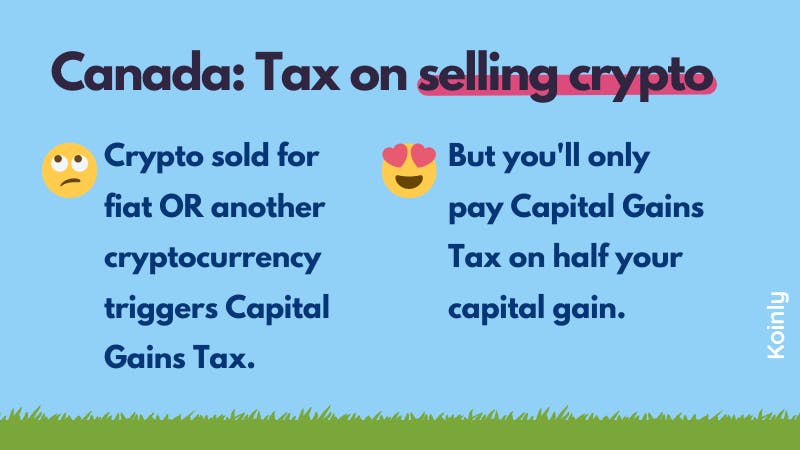

This gain is something that Bob would have to report on his income tax return and pay tax. In Canada 50 of your capital gains are taxable. Offset losses against gains.

If you sell it trade it. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. If your crypto transaction is deemed to be business-like then your generated income.

So of the 40000 profit you made upon selling you would have to report 20000 as income for your taxes on Section 5 on Schedule 3 of your income tax return. Heres 8 ways to avoid crypto tax in Canada in 2022. Final Word on Crypto Tax in Canada.

And thats how crypto taxes in Canada works. How do you avoid taxes on crypto gains. Likewise any losses are treated as business losses or capital losses.

Can CRA track Bitcoin. You can then carry forward 1000 of losses for future tax years. In theory all crypto transactions are self-reported in Canada.

However taxpayers must determine whether their crypto activity results in income or capital. With no gains in the current tax year you use 2000 to offset your capital gains from the. This is called the taxable capital gain.

You cannot use them to reduce income from other sources such as. According to a few exchanges Ive spoken to the word I got is they dont report anything to Canadian agencies beyond FINTRAC. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

For example you purchase 00017 BTC for 100. In the second year of your crypto hobby you sell DOGE for a 5000 capital loss. Yes you do need to pay tax on crypto in Canada.

To muddy the waters. Many people dont view digital assets as real so they forget that the CRA Canada Revenue Agency expects people to pay taxes on their crypto. Your capital gain is 40000 CAD.

Any capital losses resulting from the sale can only be offset against capital gains. Do I pay taxes on crypto if I dont sell. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax returns.

Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy a new car. Does Coinbase report to CRA.

Do I have to pay taxes if I convert one crypto to another. In general all income from crypto transactions is considered either business income or capital gains. Also youre only allowed to offset losses against capital gains and not ordinary income.

The CRA Canadian Revenue Agency has fairly straightforward rules when it comes to cryptocurrencies. While theres no way to legally cash out your crypto without paying taxes theres quite a few ways you can reduce your crypto tax bill. You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. This affects the way you must file your income taxes. How is crypto tax calculated in Canada.

This 100 free-of-charge service enables users to quickly generate accurate and organised crypto tax reports including transaction history and records of capital gains and losses. However youll pay either income tax or capital gains based on your investment. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more.

On most tax software this is done under the capital gains section for virtual currencies. The amount of tax you pay on crypto in Canada depends on whether you are considered to be operating a crypto business or simply trading crypto for capital gains. How are crypto day traders taxed in Canada.

Federal Income Tax Rates of 2021 and 2022. In fact there is no long-term or short-term capital gains tax rate. Its when the value of your investment decreases from the original.

Can you hold crypto in TFSA. The gains made on crypto investments are taxed the same as Provincial Income Tax and Federal Income Tax. However the Superficial Loss Rule - which applies to crypto transactions can complicate things for prolific investors using tax loss harvesting in their tax reduction strategies.

By the time you buy your new car however Bitcoin has collapsed and you sell your holdings for. So for example if you realize a gain of 10000 on selling a few Bitcoins youll only pay capital gains taxes on 5000. Crypto in Canada is subject to Income Tax or Capital Gains Tax - depending on the specific transaction.

One of the areas often overlooked when it comes to cryptocurrency is taxes. If your crypto disposal is treated as a capital gain half of your gain will be subject to tax. Interestingly only half of your capital gains are taxable.

Similarly your crypto taxes for the 2022 financial year must be filed by the 30th of April 2023. The CRA treats cryptocurrencies as a commodity and not a currency and as such crypto is subject to capital gains tax read the CRA guide. Capital loss is the inverse.

Users can import crypto. Last UpdatedMay 27 2022.

Cryptocurrency Wipeout Deepens To 640 Billion As Ether Leads Declines Cryptocurrency Bitcoin Price Bitcoin

The Week That Shook Crypto Financial Times

10 Best Cryptocurrencies Of July 2022 In 2022 Best Crypto Buy Cryptocurrency Capital Market

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Cryptocurrency Taxation How To Take A Step Forward Inter American Center Of Tax Administrations

Get The Insight On The Crypto Revolution With Capital Com Find Out What A Cryptocurrency Is And How It Works All About Cr Cryptocurrency Graphing Infographic

Swiss Tax Authorities Provide Additional Clarity On Crypto Taxation International Tax Review

Ultra Hd Abstract Bitcoin Crypto Currency Blockchain Technology World Map Background Illustration Database Artificial Stock Vector Illustration Of Bitcoin Data 112316927

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Cryptocurrency Tax Calculator Forbes Advisor

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Crypto Price Analysis January 22 Btc Eth Bsv Bch Ltc Coinspeaker Cryptocurrency Bitcoin Blockchain